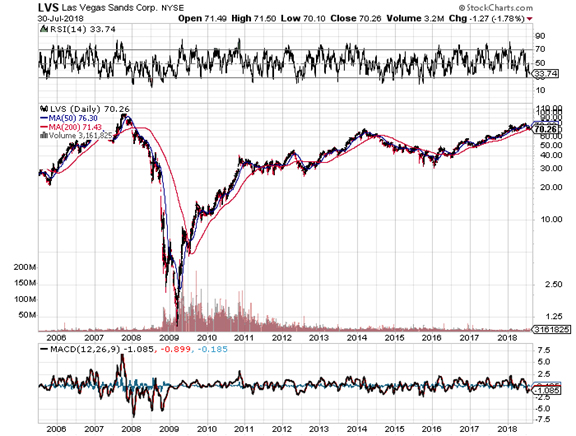

In one of the most spectacular events of overselling in recent history, Las Vegas Sands lost over 99% of its capital value in the 16 months from October 2007 to March 2009. This happened even though the casino was never in any sort of existential, or arguably even any major strategic danger during the last financial crisis. Revenues were even growing, though impairments and doubtful accounts were forcing the casino into losses. But the beauty of balance sheet impairments and doubtful accounts is that they are by their very nature temporary. Obviously business wasn’t exactly booming while the world was in a financial panic, so a decline of, say, 50-70% wouldn’t have been out of the ordinary, but nothing that warranted the stock falling over 99% from its peak.

What causes this is margin calls. When you are forced to sell, you sell at whatever the price is, whenever your broker wants her money back. It’s going to happen again. Margin is not the cause of crashes, but an aggravator of them, because debt pushes prices higher than they would otherwise go, meaning stocks have longer to fall before reaching bottom. How far they go often has nothing to do with company fundamentals. If a big bank crashes, or even several big banks, margin maintenance requirements go up across the board, and forced sales in totally unrelated securities start. A crash in Bank of America or JP Morgan can lead to forced sales in LVS or anything else for that matter. And it doesn’t matter how much margin people are using to trade LVS specifically, at all. If there is a margin balance in a brokerage account, all positions in any stocks in that portfolio are at risk of getting liquidated at any price.

Just to give you an idea of where we are now, consider the FINRA margin statistics. At market top in late 2007, total NYSE margin debt (on which LVS trades) was $379.6 billion, combining both FINRA and NYSE statistics. By February 2009, margin debt had fallen below $200 billion as margin calls forced the liquidation of debt. More importantly though, when margin debt was at its peak in 2007, total credit balances remaining were $426.7 billion, still much higher than the total margin peak. As of June, we are now at $646.9 billion in total NYSE margin debt, with a free credit balance of $179.4 billion, much lower than the total margin balance. Traders are way more levered up now than they were in late 2007. This time, when the margin fairy comes to collect her teeth from traders who got smashed in the face, she’s going to be ruthless, as if a 99% loss wasn’t.

That doesn’t mean the carnage will once again focus on LVS, but it might. NYSE trading accounts are stuffed with 70% more debt than they were back then, with 58% less available credit. Those currently levered up won’t be happy if forced to sell. We are going to have ample warning before the next financial crisis, which will be preceded by obviously strong price inflation, a negative yield spread, and slowing money supply growth. When we start seeing those signs and margin debt starts to shrink, that will be the time to start scaling in to LVS on severe down days.