Fasig-Tipton has cataloged four new supplemental entries to The November Sale that will be held on Sunday, Nov. 8, in Lexington, beginning at 2 p.m. ET.

Monthly Archives: October 2020

Oaklawn Announces Safety, Integrity Initiatives for '21

Oaklawn Park announced Oct. 29 a series of significant proposed safety and integrity enhancements planned for its 2021 racing season, subject to legislative approval.

Churchill Downs Inc. Pauses Turfway Park Construction

With a recent Kentucky Supreme Court decision on historical horse racing generating concern, Churchill Downs Inc. said Oct. 29 that it had paused construction at Turfway Park as well as the hotel planned for its flagship track in Louisville, Ky.

Illinois Gaming Board Green-Lights Fairmount Gaming

The Illinois Gaming Board gave final approval Oct. 29 for Fairmount Park in downstate Illinois to conduct sports wagering and tentative approval for the track’s planned casino.

Dutch gambling regulator celebrates ruling against EA loot boxes

Dutch gambling regulators are claiming victory in their fight against online ‘loot boxes’ offered by video game publisher Electronic Arts (EA).

On Thursday, the District Court of The Hague issued a ruling upholding an administrative order issued last year by the Kansspelautoriteit (KSA) gambling regulator that imposed penalties of up to €10m on EA for offering so-called ‘Packs’ in the company’s FIFA football video game.

The KSA’s 2019 order came after it concluded that EA’s loot boxes were an illegal game of chance under Dutch gambling regulations due to the random value of the contents, as well as the fact that the virtual items could be traded or sold for real-world currency on third party sites.

The KSA ordered video game companies to amend their products to ensure compliance with Dutch law, but neither EA nor its Electronic Arts Swiss Sàrl subsidiary complied. As a result, the KSA issued a ‘cease & desist’ order against the two EA firms, making them liable for penalties of up to €5m each.

SJM casinos lose $133m as VIP gambling turnover falls 95.5%

Macau casino operator SJM Holdings lost $133m in the third quarter as the gaming market struggled to shake off its pandemic hangover.

Preliminary figures released Thursday show the Hong Kong-listed SJM generated revenue of just HK$879m ($113.4m) in the three months ending September 30, down 89.3% from the same period last year. The company booked negative earnings of HK$782m (-182.3%) and a net loss of over HK$1b (-239.7%).

The company didn’t mince words, saying it had been “severely impacted” by the COVID-19 pandemic, and its year-to-date losses have grown to HK$2.44b as revenue slumped by nearly 80% over the first nine months of 2020.

VIP gambling turnover was down 95.5% to just HK$4.1b but an outsized 4.9% win rate (+1.8 points) limited the VIP gambling revenue decline to a slightly less onerous 93%. But the HK$200m in VIP revenue was dwarfed by the mass market table contribution of HK$690m (-89%) while slot machines suffered the smallest decline, falling 80.8% to HK$57m.

Kindred buys Rank’s last Belgian casino to ensure online gambling access

Nordic online gambling operator Kindred Group is taking its first steps into the land-based casino business after a deal for Rank Group’s last Belgian venue.

On Thursday, the Stockholm-listed Kindred announced that it had reached a deal with UK-based Rank to pay £25m for Blankenberge Casino-Kursaal (Blancas) NV, which operates Casino Blankenberge in the West Flanders city. Kindred expects the deal to close before the year’s end, pending regulatory approval.

Kindred already has ties to the Blankenberge casino, having partnered with the venue since 2012 on a locally licensed online casino and poker operation under Kindred’s flagship Unibet brand.

Kindred said the acquisition demonstrates the company’s “long-term commitment” to its Belgian online gambling customers, who are now ensured of a “broad offering” at the company’s Belgian-licensed site. Kindred plans to maintain the casino’s current management team, which is led by Dominique De Wilde.

Churchill to Move 2021 Derby Back to Traditional Date

Racing’s biggest day will return to its traditional date of the first Saturday in May in 2021 based on plans by track owner Churchill Downs Inc.

BC Turf Sprint Gives Got Stormy a Second Chance

When it was announced that Got Stormy had been entered in The November Sale, it appeared her racing career would come to an end at the Breeders’ Cup.

Red Wings extend partnership with BetMGM

The NHL’s Detroit Red Wings have announced that they will be extending their betting partnership with BetMGM.

The long-term deal means that BetMGM will continue with their on-branding at Little Caesars Arena, as well as digital signage and presence on the Red Wings digital channels. BetMGM will also provide stats and betting data for the District Detroit mobile app and provide stats and betting odds to Red Wings fans for the 2021 NHL season.

The #RedWings announced today they have renewed and expanded their strategic partnership with BetMGM.

World Traveler Magic Wand Retired After Foot Abscess

Group 1-winning globetrotter Magic Wand has been retired after a foot abscess ruled her out of running at the spring carnival in Melbourne.

Vegas casinos ask for government assistance

The U.S. casino industry faces a nervous wait as industry leaders call on the Federal government to provide financial support to stimulate an industry recovery.

Casino industry leaders are seeking tax breaks as they look to break into recovery mode from the pandemic. In March, casinos were forced into a mandatory closure, costing billions in lost tax revenue for states across the U.S.

A sense of optimism is creeping across the casino industry in the U.S. with several casinos re-opening, albeit under heavy social distancing guidelines to slow the spread of COVID-19 across tourism areas.

The casino industry is calling on the government to provide financial aid, with several casinos forced to lay off a significant portion of their staff as tourism and player restrictions continue to slow a recovery. This week the MGM Grand, Park MGM and Tropicana all announced that they would be reducing the size of their staff.

Cock kills cop as Philippines considers 5% cockfighting tax

With Philippine Offshore Gambling Operator (POGO) money quickly leaving the country, the government is looking more seriously at cockfighting as a new source of revenue. But with the activity not being legal in all parts of the country, one policeman learned just how dangerous a cock can be, the hard way.

A new bill in the House of Representatives seeks to tax offsite betting on cockfights, or sabong as its known locally. House Bill 7991 would set up an electronic gambling tax with the aim to fund coronavirus efforts, while also regulating the legal gray areas of the activity.

“The operations are already legal, by virtue of local ordinances, but the electronic aspect of it is a legal gray area. Because of the ambiguity, we are unable to levy national taxes on these activities, or look into their operations. My bill addresses that concern,” said House Ways and Means Committee Chairman Jose Maria Clemente S. Salceda, who filed the bill.

“The tax shall be 5% of gross revenues derived from offsite betting activities, and shall not be in lieu of taxes required by the local government units, and regulatory fees and charges imposed by government agencies,” Salceda said. “This is consistent with the bill’s intention not to overstep the authority of the local government units (LGUs).”

Super Rugby Unlocked Round 4 Betting Preview & Tips

It’s an action-packed weekend of rugby, with the Six Nations finishing in the U.K. and the Rugby Championship continuing in Australia. Super Rugby Unlocked heats up, with spots in the finals up for grabs in round four of the competition. Below are our tips for Super Rugby Unlocked.

Lions vs Griquas

Both of these sides will be a little undercooked, with the Lions and Griquas having a bye last weekend. The Lions are yet to win a game this season in the new competition and will be hunting their first win this weekend; having lost their last six Super Rugby matches. The Lions will be confident of claiming a win this weekend, as Griquas have also struggled in the new competition. The Griquas have managed to claim a losing bonus point in their last two games. The Lions will take this opportunity to find some winning form and mount a serious charge towards the Super Rugby title. Elton Jantjies remains the player to watch for the Lions. Jantjies has scored a try and claimed two assists in his last three matches

Lions – 12/1

Jury indicts former Wisconsin casino employee on embezzlement charges

The St. Croix Chippewa Indians of Wisconsin are not happy with a former employee they trusted to help them secure their financial operations. Leva Oustigoff, Jr. has been indicted on charges of embezzling over $72,000 from the tribe’s Turtle Bay casino and will now have to answer for his crimes. There are eight counts total and, if he’s found guilty of all of them, is looking at a terminal prison sentence.

The 58-year-old Wisconsin resident was picked up by the Federal Bureau of Investigation’s radar, which led to an investigation that involved the agency, the Internal Revenue Service (IRS) and the St. Croix tribe. They determined that, beginning in December 2015 and running until January 2018, Oustigoff was slipping out money that he then used for unspecified spending habits. The amount he illicitly withdrew varied each time he needed cash, and a Department of Justice notice about the indictment doesn’t specify how he managed to conduct his covert operations.

In December 2015, he made his first withdrawal, taking $9,500. He followed that a few months later with another swipe for $7,500, and then took an additional $1,799 later that same month. He must have had a huge pile of bills to pay in October 2017, as he managed to walk away with $20,000 on October 25 of that year. He then made his last grab on January 18, 2018, when he took about $8,600.

In anticipation of a jury hearing the charges and deciding whether they held merit, he was presented with a summons to appear after the indictment was handed down last week. However, he is currently not under arrest and is free to roam about. The summons notified him that he will need to show up in court, but no date has been set for that appearance, which will most likely be held virtually because of COVID-19.

Digital currency is becoming more important than gold with Millennials

Digital currency has reached a milestone. It has actually reached several milestones this year, facilitated by greater awareness and adoption. However, the latest one shows exactly how important digital assets have become in a very short time, and how important they’re going to be well into the future. To Millennials, digital currency is now more important than gold.

JP Morgan conducted a study recently that explored the values of different assets, and determined that Bitcoin is on its way to becoming a stronger option, especially with younger generations, than gold. The financial services firm asserts, “Cryptocurrencies derive value not only because they serve as stores of wealth but also due to their utility as means of payment. The more economic agents accept cryptocurrencies as a means of payment in the future, the higher their utility and value. The potential long-term upside for bitcoin is considerable as it competes more intensely with gold as an ‘alternative’ currency we believe, given that [Millennials] would become over time a more important component of investors’ universe.”

This obviously doesn’t indicate that Bitcoin is currently worth more than gold; however, the implications are real. In terms of tangible value and usefulness, digital currency is gaining serious amounts of traction as a currency alternative, and this is only going to continue to grow as younger generations become the older generations, and new generations enter economic societies accustomed to the use of digital assets.

The fact that JP Morgan would even be willing to utter those words is enough to indicate how far the Bitcoin ecosystem has come. It was only a couple of years ago that Jamie Dimon, the company’s CEO, screamed and shouted with everything he had that Bitcoin was a fraud. He changed his tune quickly once he understood the real-world value of digital currency, but his misguided initial reaction, shared by others, is what has kept Bitcoin from advancing more quickly.

Malta Gaming Authority head Heathcliff Farrugia makes quick exit

Heathcliff Farrugia began his career with the Malta Gaming Authority (MGA) as its chief operations officer in 2014. It only took two years for him to be bumped up to the role of chief regulatory officer for the agency, and he then quickly moved up once again a year later to take on the CEO position. After six years with the gaming regulator, however, Farrugia feels it’s time to move on and find something else to challenge him. He has announced that he won’t be renewing his contract with the MGA and resigned this past Tuesday.

The executive may have felt a little pressure to step away. Farrugia had recently become the focus of police attention over a possible connection to Jorgen Fenech, a casino operator who has been implicated in the murder of journalist Daphne Caruana Galizia. The outgoing MGA head was thought to have had extensive communication with Fenech, and investigators reportedly uncovered “suspicious communication” between the two, according to the Times of Malta. That connection led to Farrugia being questioned by Malta’s Financial Crime Investigation Department.

The timing of the sudden departure could certainly seem suspect. Farrugia is leaving along with Karl Brincat Peplow, the MGA’s chief officer for authorizations, and the regulator asserts that they are exiting to start an unspecified joint venture project. However, it’s uncommon for any entity to lose its boss – let alone two top executives – without extensive warning.

The MGA and the Malta Financial Service Authority have been embroiled in a scandal that began to unravel following Galizia’s death. Fenech is said to have some link to the car bomb that killed her in 2017 in what has been described as a retribution attack after she exposed high-profile crimes in Malta that involved politicians and their inner circles. The death led to international pressure for the culprits to be found, and the investigation has uncovered some interesting facts along the way.

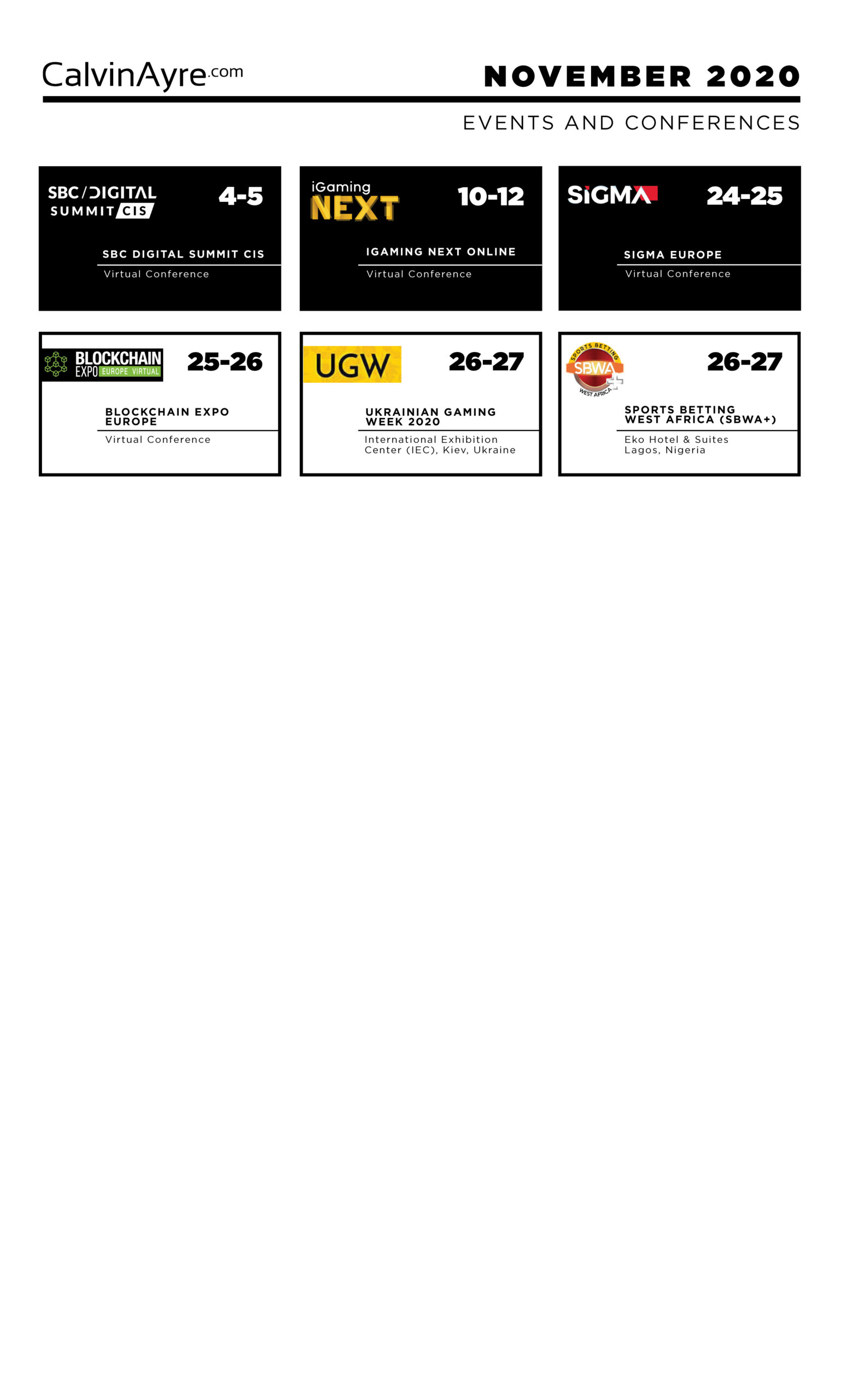

CalvinAyre.com November 2020 Featured Conferences & Events

SBC Digital Summit CIS

SBC is set to host the largest virtual event dedicated to the CIS region. Bringing their fully featured digital platform, participants will have access to a full agenda of conference speakers, virtual exhibits and networking lounges.

This CIS focused virtual event will feature 75 world class speakers, 25 exhibits and over 1,500+ delegates. If you want to learn more about the exceptional opportunities CIS has to offer, like in Ukraine, Georgia or Uzbekistan, and network yourself into a lucrative deal, this is a must attend event, and it’s free to register!

What: SBC Digital Summit CIS

LVS exit from Las Vegas could signal a shift to Asia-centric ops

The recent revelation that Las Vegas Sands (LVS) was looking for buyers for its casinos on the Las Vegas Strip caught some off guard, given the history the Sheldon Adelson-led company has had in Nevada and across the U.S. LVS is already exploring a possible deal to get rid of three Vegas properties for around $6 billion, but it most likely won’t extricate itself entirely. Instead, according to some analysts, the casino operator could work out management deals, through the use of a real estate investment trust (REIT), to keep a finger in the pot, but which would allow it the financial freedom to concentrate most of its efforts on Asia.

Sanford C. Bernstein analysts believe this would be the most likely outcome for LVS. This is similar to what MGM Resorts International did earlier this year when it used an REIT to sell and then lease back the MGM Grand and Mandalay Bay, and REITs have become much more common in the casino industry in recent years. By selling the assets and then leasing them back, operators can reduce expenses and pick up massive injections of cash that can be used for other activity.

Bernstein analysts Vitaly Umansky, Kelsey Zhu and Tianjiao Yu explain, “While we do not know at this time if there are actual potential buyers, it is possible that any acquisition may include a REIT as a purchaser (along with either a private equity buyer or a strategic). Further it is possible that a sale may only be a sale-leaseback to a REIT with LVS retaining the LV operations. The sale-leaseback structure has been commonplace for casinos in the U.S. for some time … while we view such transactions as largely financing in nature (replacing debt and debt service with a lease and rental payments), investors have looked favorably upon such financial engineering. However, we are not convinced that this is a structure that LVS would like to pursue (although it could be an eventual outcome).

LVS is apparently negotiating a deal for the Palazzo, the Sands Expo Convention Center and The Venetian Las Vegas that could be completed through an REIT. However, Morgan Stanley isn’t convinced the $6-billion price point is valid. The firm’s Thomas Allen points out, “We are not sure how much interest from strategic buyers there might be given the high absolute price, other reportedly available assets on the Strip, and the unique positioning of the properties. However, given the potential for a cheaper OpCo price through a sale leaseback and historically relatively steady EBITDA, there could be other interest.”

Man pleads guilty in Vegas casino-tied illegal money business

An ongoing investigation into illegal money transactions involving China and the U.S. has netted two more criminals. Fan Wang has pleaded guilty to their involvement in the sham operations, which included the facilitation of the exchange of Chinese yuan by high rollers visiting Las Vegas-area casinos. His next stop will be a visit to a courtroom so a judge can provide sentencing, which is expected to occur in late January 2021.

Since Chinese law doesn’t allow anyone to convert more than $50,000 yuan to U.S. dollars, gamblers needed a workaround in order to hit the Vegas casino scene with large stacks of cash. Seizing the entrepreneurial opportunity, Wang is said to have been working with unnamed casino hosts to be put in contact with the individuals, for whom he would provide money exchange services. Upon transferring yuan to his Chinese bank account electronically, he would give them the dollars they needed to hit the casino floors.

Several law enforcement departments, as well as the U.S. Internal Revenue Service (IRS), have been investigating similar activity for the past several years, and Wang is just the latest to be popped. He acknowledged his participation to the courts yesterday and pleaded guilty to operating an unlicensed money transmitting business and has to forfeit $225,000 as a result of the plea agreement. It isn’t clear how much money he may have laundered, or how much he earned in the process.

States U.S. Attorney Robert Brewer, “As this series of guilty pleas makes abundantly clear, individuals facilitating the illegal transfer of money to and from China will be held accountable. The security of our banking system depends on it.”