Online gambling technology supplier NetEnt is weathering the COVID-19 pandemic just fine thanks to UK and US market growth.

In a first-quarter earnings preview released Wednesday, the Stockholm-listed NetEnt said its revenue totaled SEK518m (US$51.2m) in the three months ending March 31, nearly 24% higher than the company reported in the same period last year.

Earnings were up nearly 17% to SEK229m and would have risen higher were it not for SEK26m in restructuring costs associated with the integration of software provider Red Tiger Gaming, which NetEnt acquired last September. Those costs, as well as earn-out obligations related to the acquisition, pushed after-tax earnings down by nearly one-third to SEK82m.

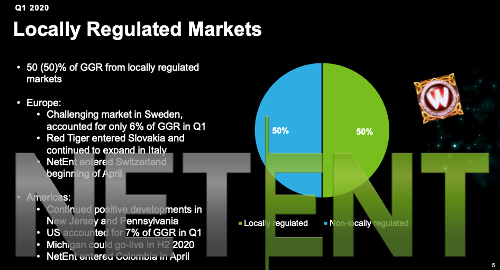

NetEnt CEO Therese Hillman said most of Q1’s growth came from the US and UK markets, which offset continued “negative” results in Sweden and Norway. Sweden’s share of NetEnt’s overall revenue has fallen to just 6%, while the US now accounts for 7% thanks to strong growth in New Jersey’s online casino market and the launch of regulated online casino in Pennsylvania.