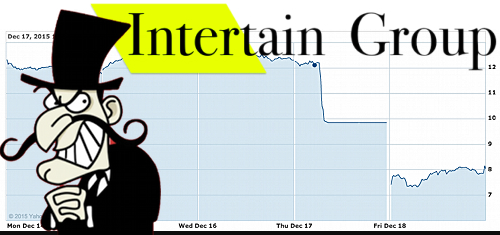

Canadian online gambling operator Intertain’s shares lost more than one-third their value in two days following the release of a hedge fund’s highly critical report on the company.

On Thursday, Spruce Point Capital Management (SPCM) released a 120-page report (read it here) on Intertain that took major issue with the company’s performance to date and future outlook, cast aspersions on the backgrounds of senior management figures and basically suggested Intertain was a Ponzi scheme.

To get a sense of the report’s tone, consider this passage, in which the authors express concern that Intertain “could exist primarily as a vehicle that enriches insiders and advisors, while leaving shareholders left holding a collection of mature gaming assets, saddled with C$758m of debt and financial obligations.”

The report is laced with similarly salacious quotes, including concerns about the company “flipping through three auditors like pancakes” or “the mountain of debt placed on its largely intangible asset base” while speculating that “Intertain is highly likely to roll snake eyes.”