Tennessee sports bettors will soon have a fifth online option while one of its current licensees’ ties to a high-interest lending firm are raising responsible gaming concerns.

This week, the Tennessee Education Lottery’s Sports Wagering Committee gave conditional approval to Churchill Downs Incorporated (CDI) to launch online betting (the only kind permitted in the state) under its BetAmerica brand. CDI, which recently announced plans to rebrand BetAmerica as TwinSpires, still needs to clear a few technical hurdles before launching in Tennessee.

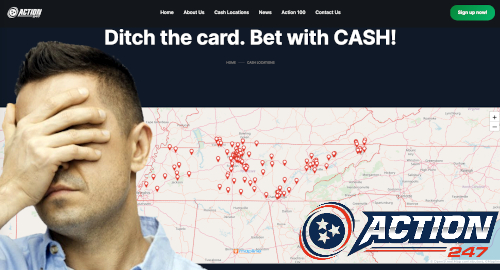

CDI joins existing licensees BetMGM, DraftKings, FanDuel and local firm Action 24/7, with another three would-be licensees – William Hill, Wynn Resorts’ WynnBET and ZenSports – still waiting in the wings. It remains to be seen whether any of the latter trio will be able to launch in time for this year’s Super Bowl on February 7.

Meanwhile, the Tennessee Lottery has issued a betting vendor registration to Advance Financial, a Nashville-based fintech firm that offers so-called ‘flex’ loans, which are effectively a line of credit with seriously high interest rates (279.5% APR) for borrowers with few other options. So, payday loans.