Casino operator Genting Malaysia is hoping that the Kuala Lumpur High Court will provide larger tax savings for the company.

In its filing, Genting Malaysia said that the High Court has granted its application for leave to begin judicial review of the Malaysian Ministry of Finance’s (MoF’s) amendments of an agreement that gave the company certain tax incentives, including an income tax exemption equivalent to 100% of qualifying capital expenditure incurred for a 10-year period.

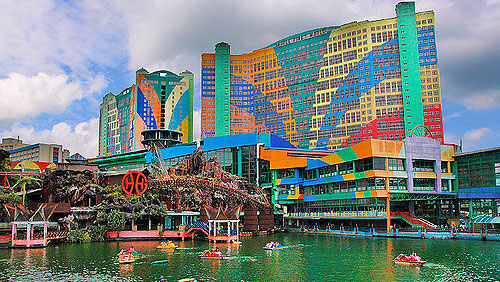

The approval of such incentives had been granted in December 2014 in connection with the Genting Integrated Tourism Plan (GITP), but in December 2017, an amendment was made that “does not remove the tax incentives previously granted but will effectively prolong the utilisation period of the tax allowances significantly.”

According to a Maybank IB Research note cited by GGRAsia, this meant the payment of an additional MYR166.2 million ($40.1 million) in income taxes, increasing the losses the operator incurred in the third quarter of last year.