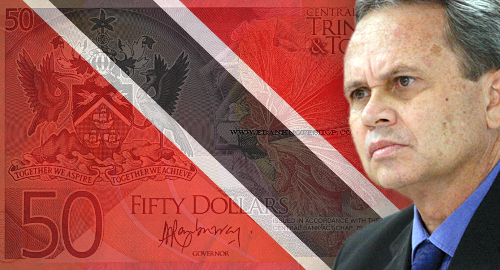

Gaming operators in Trinidad and Tobago are protesting the government’s new tax plan, which will see most fees double by 2018.

On Monday, Trinidad and Tobago’s Finance Minister Colm Imbert (pictured) unveiled his budget presentation for the 2017-18 fiscal year. Saying these were “unusual times which call for major changes in policies,” Imbert said the situation required “serious adjustment for all” and warned that the new measures “will be strictly enforced.”

The budget imposes a new 10% tax on players’ lottery winnings that will take effect on December 1. The National Lotteries Control Board (NLCB) reported last week that it had enjoyed its highest ever profits in 2016.

Among the other changes is a flat fee of TTD 120k (US $17,820) on each electronic roulette machine in local bars. Other amusement machines in bars will see their fees double to TTD 6k ($891).