While Labor Day weekend has something of an anti-climactic feel in the wake of a history-making Travers Stakes (gr. I), there are still 35 races to be run at the “September place to be” over the last three days.

Monthly Archives: September 2016

DraftKings funding round raises $153m

Daily fantasy sports operator DraftKings has raised $153m via a new funding round, suggesting some investors still have faith that the company may one day turn a profit.

On Thursday, DraftKings announced its new cash infusion but declined to specify at what price point the new investors had bought in. The Boston Globe reported that the financing valued DraftKings at around $1b, around half the price the company was believed to be worth prior to last year’s spectacular DFS meltdown.

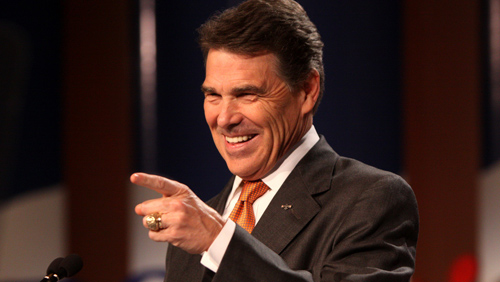

Among the new investors is Revolution Growth, a venture capital firm led by Ted Leonsis (pictured), who owns both the NBA’s Washington Wizards and the NHL’s Washington Capitals. Leonsis has previously supported calls to end the federal ban on real sports betting and holds a major stake in sports data providers Sportradar AG, whose clients include major international bookmakers.

DraftKings CEO Jason Robins issued a statement welcoming his new backers while claiming that the latest funding round was “oversubscribed.” Robins singled out Revolution Growth as “a tremendous new partner” that has “deep expertise in sports, technology and policy.” Revolution partner Steve Murray has been given a seat on DraftKings’ board of directors.

DraftKings funding round raises $153m

Daily fantasy sports operator DraftKings has raised $153m via a new funding round, suggesting some investors still have faith that the company may one day turn a profit.

On Thursday, DraftKings announced its new cash infusion but declined to specify at what price point the new investors had bought in. The Boston Globe reported that the financing valued DraftKings at around $1b, around half the price the company was believed to be worth prior to last year’s spectacular DFS meltdown.

Among the new investors is Revolution Growth, a venture capital firm led by Ted Leonsis (pictured), who owns both the NBA’s Washington Wizards and the NHL’s Washington Capitals. Leonsis has previously supported calls to end the federal ban on real sports betting and holds a major stake in sports data providers Sportradar AG, whose clients include major international bookmakers.

DraftKings CEO Jason Robins issued a statement welcoming his new backers while claiming that the latest funding round was “oversubscribed.” Robins singled out Revolution Growth as “a tremendous new partner” that has “deep expertise in sports, technology and policy.” Revolution partner Steve Murray has been given a seat on DraftKings’ board of directors.

DraftKings funding round raises $153m

Daily fantasy sports operator DraftKings has raised $153m via a new funding round, suggesting some investors still have faith that the company may one day turn a profit.

On Thursday, DraftKings announced its new cash infusion but declined to specify at what price point the new investors had bought in. The Boston Globe reported that the financing valued DraftKings at around $1b, around half the price the company was believed to be worth prior to last year’s spectacular DFS meltdown.

Among the new investors is Revolution Growth, a venture capital firm led by Ted Leonsis (pictured), who owns both the NBA’s Washington Wizards and the NHL’s Washington Capitals. Leonsis has previously supported calls to end the federal ban on real sports betting and holds a major stake in sports data providers Sportradar AG, whose clients include major international bookmakers.

DraftKings CEO Jason Robins issued a statement welcoming his new backers while claiming that the latest funding round was “oversubscribed.” Robins singled out Revolution Growth as “a tremendous new partner” that has “deep expertise in sports, technology and policy.” Revolution partner Steve Murray has been given a seat on DraftKings’ board of directors.

DraftKings funding round raises $153m

Daily fantasy sports operator DraftKings has raised $153m via a new funding round, suggesting some investors still have faith that the company may one day turn a profit.

On Thursday, DraftKings announced its new cash infusion but declined to specify at what price point the new investors had bought in. The Boston Globe reported that the financing valued DraftKings at around $1b, around half the price the company was believed to be worth prior to last year’s spectacular DFS meltdown.

Among the new investors is Revolution Growth, a venture capital firm led by Ted Leonsis (pictured), who owns both the NBA’s Washington Wizards and the NHL’s Washington Capitals. Leonsis has previously supported calls to end the federal ban on real sports betting and holds a major stake in sports data providers Sportradar AG, whose clients include major international bookmakers.

DraftKings CEO Jason Robins issued a statement welcoming his new backers while claiming that the latest funding round was “oversubscribed.” Robins singled out Revolution Growth as “a tremendous new partner” that has “deep expertise in sports, technology and policy.” Revolution partner Steve Murray has been given a seat on DraftKings’ board of directors.

77 Year Old William Vo & Pat Lyons Headline WPT Legends of Poker Final Table

The 2016 World Poker Tour (WPT) Legends of Poker at the Bicycle Casino in Los Angeles began with 687 players, but after four days of play, it’s now down to the final table of six. And as the old saying goes, slightly paraphrased: age and treachery are holding court on the felt. The two favorites […]

The post 77 Year Old William Vo & Pat Lyons Headline WPT Legends of Poker Final Table appeared first on .

Pensioned Stallion Ide Arrives at Old Friends

Old Friends Thoroughbred Retirement Farms welcomed a new horse in Ide Aug. 29 and, according to farm founder Michael Blowen, he’s a head-turner.

Owner Aims to End 'Jail Time' Restrictions

Owner Jerry Jamgotchian has filed a civil case in U.S. District court that argues an Indiana rule that requires horses claimed in the state to wait at least 60 days before racing outside Indiana is invalid under federal law.

N.H. supermarket donates lottery commission to charity

A New Hampshire grocery store that sold a mammoth winning Powerball ticket announced Tuesday that it is donating its commission to local charities that work with children or hunger.Powerball, Retailer, New Hampshire, Charity, Multi-State Game

Denmark’s sports betting market stalls despite Euro 2016

Denmark’s regulated online gambling market saw sports betting revenue decline in the second quarter, despite the impact of the Euro 2016 football tournament.

Figures released Thursday by the Spillemyndigheden regulatory agency showed total betting and online gaming revenue of DKK 935m (US $140.7m) in the three months ending June 30. The figure is 16% higher than the same period last year but 4% lower than Q1 2016’s total.

The online casino vertical generated revenue of DKK 355m, up one-fifth year-on-year and up 3% sequentially. Online poker was flat year-on-year at DKK 40m but down DKK 5m sequentially.

Slots remain the dominant form of online casino play, scoring 68% of the total casino revenue pie, with roulette (6%) and blackjack (5%) the next most popular casino games.

Hogan to Be Honored for Aftercare Commitment

Dr. Patricia Hogan will be honored with the first-ever New York Thoroughbred Horsemen’s Association “EquiStar Award” for her dedication and outstanding work on behalf of New York’s retired racehorses.

Brown’s Stable Loaded in Saranac on Turf

With six wins in the nine graded turf stakes on the flat at the Saratoga Race Course meet, trainer Chad Brown looks poised to add to that tally as he sends out three solid contenders in the seven-horse field entered in the Saranac Stakes (gr. IIIIT).

Appeal Filed Over Sword Dancer Decision

Kirk Wycoff of Three Diamonds Farm Aug. 29 filed an appeal to the New York State Gaming Commission regarding the decision of the stewards to take no action against longshot Inordinate in the Aug. 27 Sword Dancer Stakes (gr. IT).

Slow activity in Wynn Palace disappoints analysts

More than a week since Wynn Resorts Ltd.’s $4.2 billion Macau resort opened its doors to the public, analysts are already seeing some writings on the wall.

Bloomberg reported that the slow entry of tourists and the possibility that Wynn Palace taking business from local rivals is causing concern to analysts that are tracking the performance of the mega resort, which opened on August 23.

Unlike other recent casino openings, Union Gaming analyst Grant Govertsen pointed out in a research note on Monday that tourist influx in the casino, particularly the mass market customers, “felt slow.”

He also pointed out several reasons preventing mass-market customers from staying in the 1,700-room resort, including the exorbitant cost of gondola ride; the long walk around the lake to get to the casino entrance; and the light rail construction in front of the resort.

Runhappy Works Five Furlongs in :58

Runhappy, last year’s sprint male champion, recorded his second public work of the year Sept. 1 at Keeneland, zipping five furlongs in :58. He is being pointed toward the one-turn mile Ack Ack Handicap (gr. III) Oct. 1 at Churchill Downs.

Distress in Gaming: A Special Re-Broadcast of a Webinar

Interview with Virginia McDowell, President & COO, Isle of Capri Casinos

Macau breaks 2-year slump with 1.1% growth in August

After 26 straight months of decline, Macau has finally recorded its first growth.

The world’s biggest casino hub saw its gross gaming revenue eke a 1.1 percent growth in August to reach MOP18.8 billion (USD2.4 billion)—the first upward tick for the former Portuguese enclave since May 2014, when its monthly revenues plummeted to five-year lows due to slow economic growth and Beijing’s crackdown on corruption.

Macau’s August performance beat the analysts’ prediction of 1.5 percent drop, thanks to the opening of Steve Wynn’s $4 billion Wynn Palace resort in Cotai.

“All of our conversations with the Big 6 operators have suggested that August trends were good, especially at the mass market level. However, we believe the growth in GGR was likely attributable to some number of high-end players coming to Wynn Palace,” Union Gaming analyst Grant Govertsen said in a note.

Prop Betting: Will Ex-Gov. Rick Perry Dance To His Redemption?

A Cinderella story.

Most people love hearing such a story – of how a person who started out in a dire circumstance was able to turn his life around and has lived happily ever after. There are those who root for the underdogs, hoping that despite the odds, they will come out the victor.

But for some reason, people are finding it difficult to root for former Texas Gov. Rick Perry – even just on reality TV show, Dancing With the Stars.

As a backgrounder, Perry failed to get the Republican Presidential nomination, not once but twice and has somehow become a staple of American jokes. Members of the LGBTs hates him for his views on homosexuality and his anti-same-sex marriage stance.

Samsung mulls adopting blockchain for key operations

South Korean electronics giant Samsung is reportedly considering how blockchain can be used in today’s evolving financial and technology sectors.

Blockchain is the underlying technology that supports popular digital currency bitcoin. It makes use of cryptography to create a distributed ledger system in order to hold and spend money in a more open, transparent and flexible manner compared to the traditional bank or credit card companies.

And this is what the Samsung Group is looking into. According to The Korea Times, CEOs of the multinational company recently attended a lecture on the technology.

A report claimed Samsung was planning “to set up a blockchain system among its financial subsidiaries as early as October, to expand it to diverse financial services next year.” But this was refuted by a Samsung Group spokesman, who told The Korea Times that the executives attended the lecture to learn the basic concepts of the technology.