UK-listed gambling giant GVC Holdings says its global online strength and US market expansion will allow it to withstand the imminent shakeup of its UK retail business.

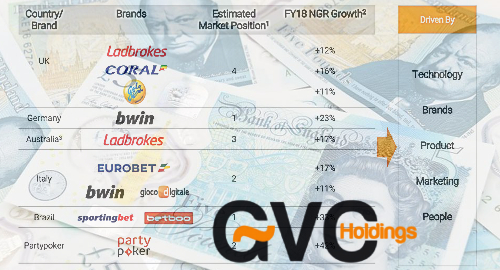

GVC released its official FY18 financial report card on Tuesday, the results of which largely mirrored January’s earnings preview. GVC’s business underwent a major transformation last year due to its completion of the Ladbrokes Coral acquisition, plus the Neds and Crystalbet deals, so we’ll focus on the ‘pro forma’ numbers, which assumes that these entities were already one big happy money-hoovering family in 2017.

GVC’s 2018 net gaming revenue (NGR) was up 9% year-on-year to £3.57b, gross profit improved 7% to £2.4b, underlying earnings rose 13% to £755.3m and underlying operating profit jumped 19% to £610m. In actual numbers, underlying profit before tax nearly tripled to £434.6m but the company booked a net loss after tax of £56.4m primarily due to non-cash write-offs of acquired intangibles.

GVC’s online operations were the report’s unquestioned stars, with much of the credit going to the continuing turnaround of the bwin and PartyPoker brands, although the Lads Coral UK-facing online brands’ performance was dubbed “particularly pleasing.” GVC noted that it’s still “early days” but it sees “a significant opportunity” in reinvigorating the Ladbrokes brand.