Tapwrit, winner of the Lambholm South Tampa Bay Derby (G2) and sixth in the May 6 Kentucky Derby Presented by Yum! Brands (G1), worked five furlongs in 1:02.25 under his regular jockey Jose Ortiz in preparation for the Belmont Stakes (G1).

Monthly Archives: May 2017

Churchill Completes Rare Guineas Double

Only eight 3-year-olds have won both the English 2,000 Guineas and the Irish 2,000 Guineas. On May 27 Coolmore owned/Ballydoyle trained Churchill became number nine.

Miss Temple City Set for Royal Ascot Venture

For her latest turn on the worktab, trainer Graham Motion gave Miss Temple City a little taste of some race-day atmosphere when he worked her on the turf at Fair Hill Training Center May 27 just prior to the Saturday’s slate of steeplechase events.

Gormley Works for Possible Belmont Start

Before and after Gormley logged his workout May 27 at Santa Anita Park, trainer John Shirreffs emphasized that, although the June 10 Belmont Stakes (G1) is under consideration, nothing is set in stone.

J Boys Echo Confirmed For Belmont Run

Gotham Stakes (G3) winner J Boys Echo will head to New York for a planned start in the June 10 Belmont Stakes (G1), Jason Loutsch of owners Albaugh Family Stable confirmed May 27.

Book Review: ‘Advanced Concepts in No-Limit Hold’em’ Offers Solid Game Theory Info You Can Use

I used to go to the library often to read poker books when I first started playing, which was back in 2003. I tried to consume as much information as […]

The post Book Review: ‘Advanced Concepts in No-Limit Hold’em’ Offers Solid Game Theory Info You Can Use appeared first on .

Irish War Cry Returns to Worktab; Belmont Run Possible

In his first workout since finishing tenth in the May 6 Kentucky Derby Presented by Yum! Brands (G1), Irish War Cry kept the door open for a start in the Belmont Stakes (G1) when he turned in a five-furlong move at Fair Hill Training Center May 27.

Maker a Triple Threat in Arlington Classic

Trainer Mike Maker has three sophomores for the May 27 Arlington Classic Stakes (G3T), including Kentucky Derby Presented by Yum! Brands (G1) runner Fast and Accurate.

Weekend Stakes Rundown: Gold Cup Day

Consider this your weekly guide to the best stakes races in North America. This week a pair of grade 1 races at Santa Anita Park and graded stakes at six other racetracks.

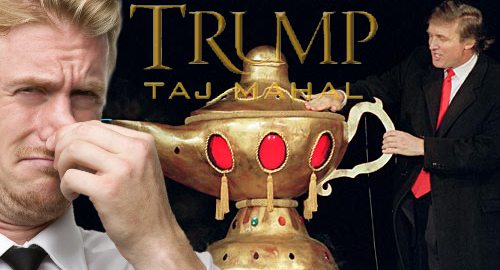

Hard Rock Int’l to spend $500m ridding Taj Mahal of Trump taint

The chairman of casino operator Hard Rock International (HRI) can’t wait to rid the Trump Taj Mahal of everything that reminds people of the current occupant of the White House.

In March, HRI struck a deal with Donald Trump’s buddy Carl Icahn to acquire the shuttered Atlantic City casino and promptly announced plans to spend $375m remodeling the joint as the new music-themed Hard Rock Atlantic City, which is set to re-open in summer 2018.

Speaking at this week’s East Coast Gaming Congress, HRI chairman Jim Allen announced that the company’s remodeling plans were likely to cost closer to $500m. HRI is serious about making a splash in AC, and Allen said that it “does us no good to put some guitars on the wall and new carpets, and say ‘I can take 5 or 10% of the business from Resorts or Harrah’s.”

But the increased price tag also reflects HRI’s desire to purge the property of the current US president’s tacky design aesthetic. “It’s everywhere,” the Associated Press quoted Allen – who used to work for Trump back before the spray-tanned mogul’s casino empire crumbled – expressing revulsion at “all those minarets and all that purple. Jesus! What were we thinking?”

GAME Act Seeks to Legalize Sports Betting (and Online Gambling) Nationwide

Despite deflated chances in the US Supreme Court, legal and regulated sports betting across the entire United States could still be in the cards. Earlier this week, the US solicitor […]

The post GAME Act Seeks to Legalize Sports Betting (and Online Gambling) Nationwide appeared first on .

Litfin: Gold Cup Figures to Set up Well for Accelerate

The grade 1 action is at The Great Race Place on Saturday, May 27 of Memorial Day weekend, as the $300,000 Gamely Stakes and $500,000 Gold Cup at Santa Anita Stakes share top billing.

First Black-type Winner for Freshman Havana Gold

Tweenhills Farm & Stud’s freshman sire Havana Gold garnered his first black-type winner May 25 when his son Havana Grey won the Better Odds With Matchbook National Stakes by a length at Sandown Park in England.

Familiar Faces Highlight New York Showcase

Big Apple Showcase Day for New York-breds at Belmont Park has solid fields for all six of its stakes races. The $200,000 Commentator Stakes and $125,000 Kingston Stakes have drawn many top older runners.

Global Daily Fantasy Sports acquires B2B operator Mondogoal

Vancouver-based B2B daily fantasy sports platform provider Global Daily Fantasy Sports Inc. (GDFSI) has struck a deal to acquire European DFS operator Mondogoal.

On Friday, GDFSI announced its acquisition of Mondogoal’s operating assets, including intellectual property and trademarks as well as Mondogoal’s DFS B2B client contracts in Italy.

Mondogoal’s Italian client list includes Lottomatica and Sisal, and GDFSI says it has secured new agreements with each operator for additional two-year terms. GDFSI is a subsidiary of International Game Technology (IGT), which counts Lottomatica among its many subsidiaries, which likely helped smooth the transition no end.

Precise terms of the deal weren’t disclosed, with GDFSI saying only that the consideration consisted of “a small cash payment” plus common shares of GDFSI “having a value equal to net gaming revenues from the purchased assets over the next three years.“

Zayat Pinhooking Venture Returns Large Profit

In its first year, a pinhooking venture established by Ahmed Zayat sold eight 2-year-olds for sold for $4.155 million, a healthy return on the aggregate yearling purchase price of $1.63 million.

Paddy Power Betfair closing Gibraltar office, not a Brexit play

UK-listed online gambling operator Paddy Power Betfair is closing its Gibraltar office and surrendering its local online gaming license.

Late Thursday, local media outlet GBC reported that Paddy Power Betfair (PPB) was preparing to board up its Gibraltar office, which employs around 20 individuals. A PPB spokesperson said all Gibraltar staffers would be offered relocation opportunities in London and Dublin.

PPB said the decision to close the office and relocate its functions was the result of an operational review that followed last year’s merger of Paddy Power and Betfair and reflected the company’s desire to simplify and centralize its operations. The company similarly ditched its Isle of Man presence last year.

Gibraltar’s government saw fit to address PPB’s exit, issuing a statement saying it had “a great working relationship” with the company but understood that the office had become “surplus to requirements” following the merger.

Graded Stakes Winner Destin Set for 2017 Debut

Multiple graded stakes winner Destin, runner-up in last year’s Belmont Stakes Presented by NYRA Bets (G1), is set to make his first start in nearly nine months when he goes to post May 28 in an allowance optional claiming race at Belmont Park.

2017 World Series of Poker Preview: Can Jason Mercier Repeat his Insane 2016 Performance?

Can you believe it, the 2017 World Series of Poker is but a few days away? No offense to Christmas season, but this truly is the most wonderful time of […]

The post 2017 World Series of Poker Preview: Can Jason Mercier Repeat his Insane 2016 Performance? appeared first on .

Always Dreaming Officially Ruled Out of Belmont Stakes

Always Dreaming, winner of the Kentucky Derby Presented by Yum! Brands (G1), will bypass the June 10 Belmont Stakes (G1) as expected and be freshened for a summer campaign, Terry Finley of West Point Thoroughbreds confirmed May 26.