Online gambling continues to gobble up an ever-larger share of the overall UK market, while gaming machines in betting shops saw their share decline for the first time ever.

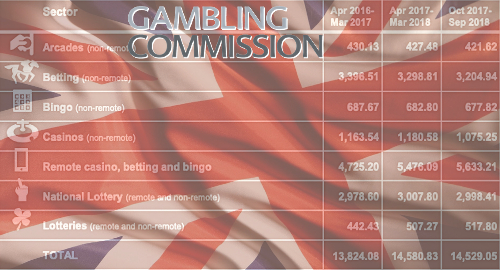

On Thursday, the UK Gambling Commission (UKGC) released its latest statistics on the UK market for the 12 months ending September 2018. During that span, UK-licensed operators generated gross gambling yield (GGY) of £14.5b, which the UKGC says represents a 0.4% decline from the 12 months ending March 2018 (although they originally reported GGY of £14.4b during that period, so bear in mind that these figures apparently aren’t carved in stone).

Regardless, online gambling’s growth continued unabated, accounting for GGY of £5.63b and a market share of 38.8%, up from 37.1% in the previous period. Online casino games accounted for nearly £3b (+1.8%) of this total, two-thirds of which came via slots. While online race and sports betting was essentially flat at £2.1b, overall online ‘betting’ was up 3.7% thanks to exchange betting rising 21% to nearly £343m and bingo improving 7.6% to £177.6m.

Land-based bookmakers’ GGY ranked second in the pecking order with £3.2b, down around £94m from the previous period. Gaming machines continued to account for the bulk (59.2%) of bookmakers’ GGY but this number fell £5.6m to £1.83b. It’s a modest decline but it’s the first backward step the machine category has taken since the UKGC began keeping score.